A web of suspicious transactions involving IJM Corporation Berhad’s chairman, Tan Sri Dato’ Tan Boon Seng @ Krishnan Tan, and his close associate Seow Lun Hoo @ Seow Wah Chong has drawn the attention of both Malaysian and international investigators. Reports from an international portal and local financial blogs allege that the UK’s Serious Fraud Office (SFO) is probing potential money laundering and bribery linked to offshore assets exceeding RM2.5 billion.

Financial records reportedly show multiple high-value foreign accounts and extraordinary fund movements — raising serious concerns about corporate integrity and public accountability within one of Malaysia’s largest conglomerates.

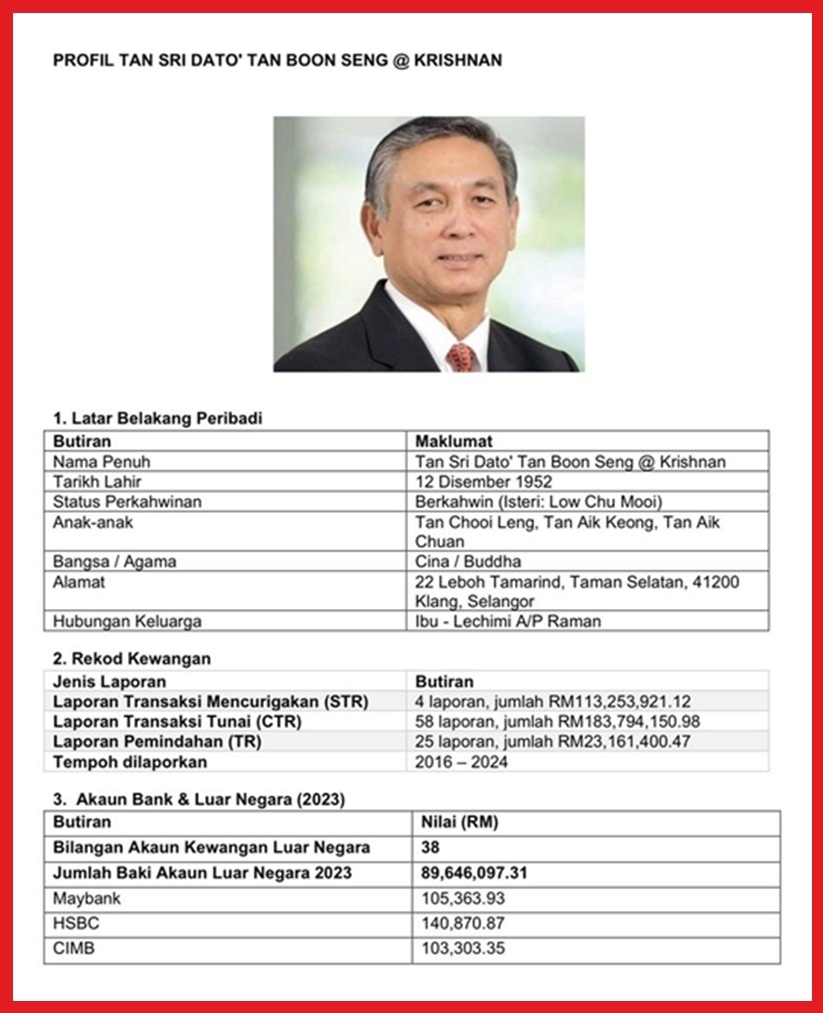

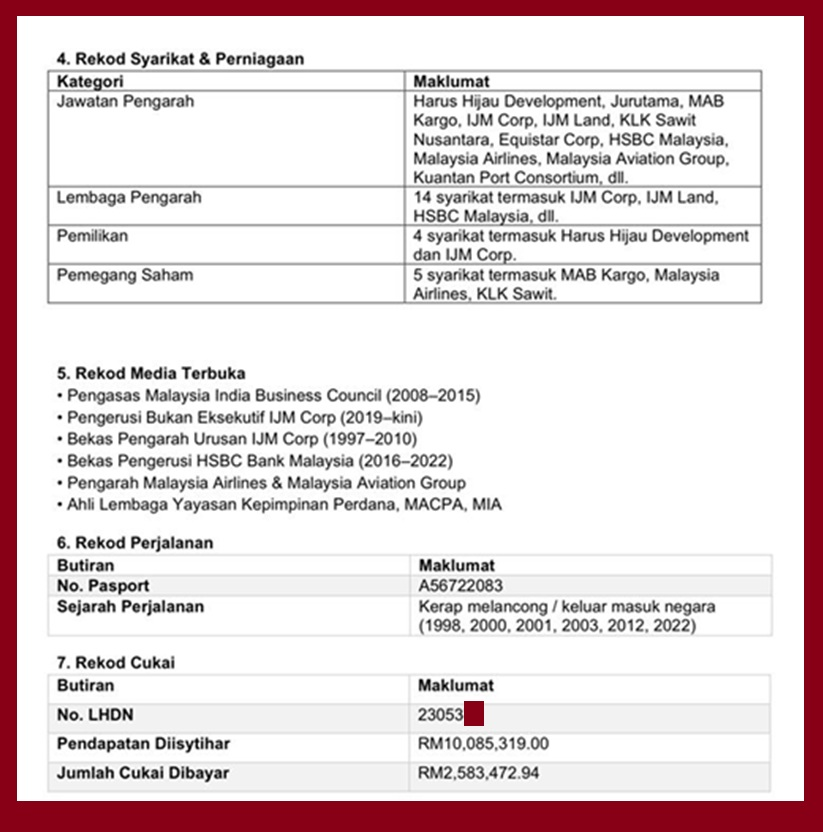

SFO Probe: RM90 Million in Offshore Accounts and Unusual Transactions

According to international reports, the SFO is investigating transactions tied to billions of ringgit in alleged illicit investments linked to Tan Sri Krishnan. While both IJM and the chairman have denied wrongdoing, financial disclosures suggest he controls offshore assets worth RM89.6 million, accompanied by dozens of unusual cash and transfer reports flagged by monitoring systems.

The same sources also tied IJM to a RM170 million political funding allegation involving former Prime Minister Datuk Seri Ismail Sabri Yaakob, allegedly sourced from MRT project lobbying funds — claims that remain officially denied but continue to circulate among financial watchdogs.

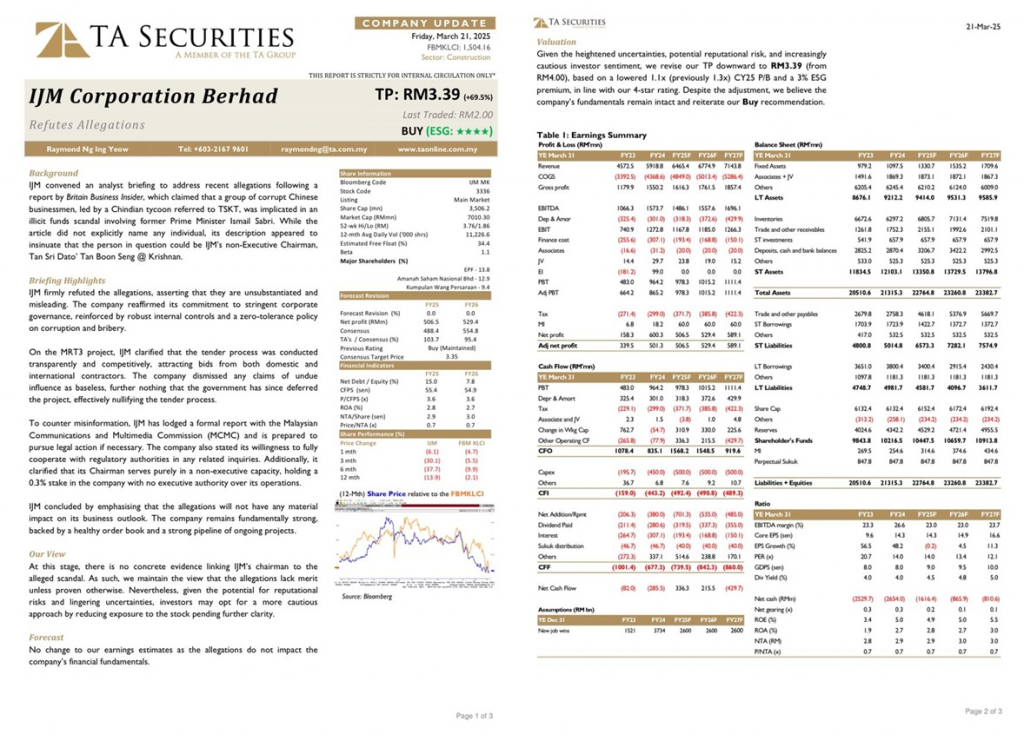

Investor confidence has taken a hit: since March 2025, IJM shares have fallen 34% to RM1.93, the lowest in 14 months, amid growing concerns over transparency and governance.

Strategic Toll Assets: PNB’s Alleged Role in Prolintas Sale to IJM

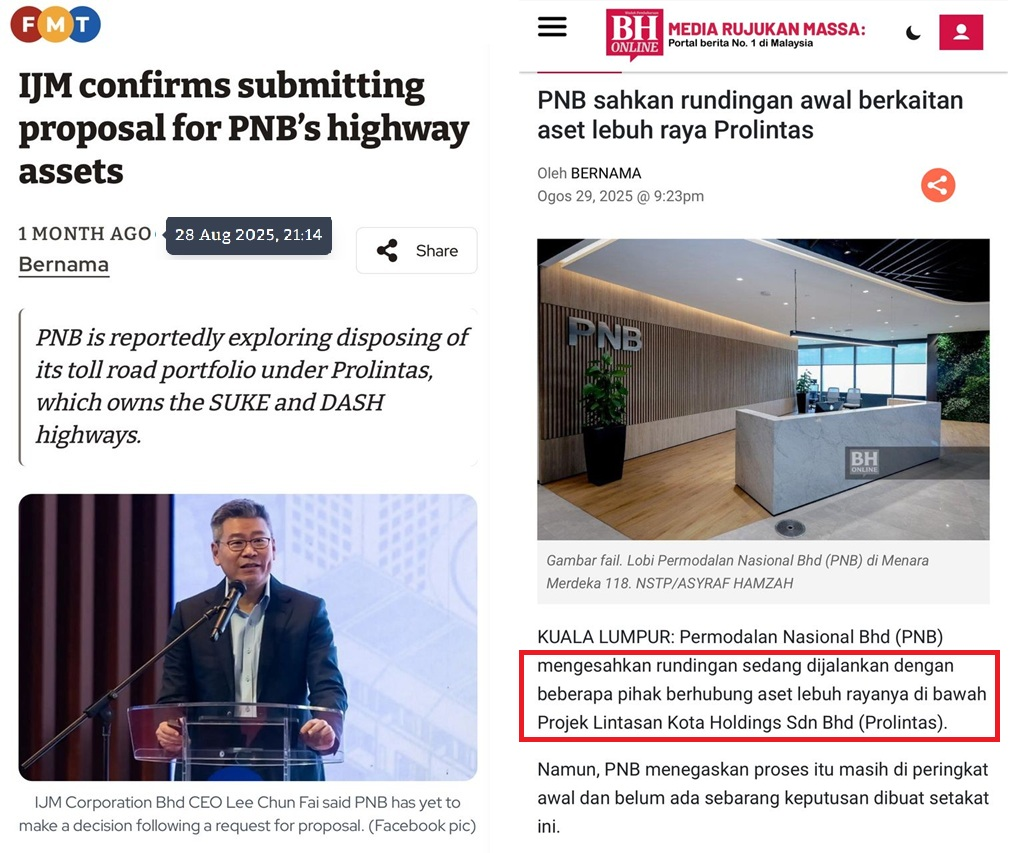

Recent revelations suggest that Permodalan Nasional Berhad (PNB) is orchestrating the sale of strategic highway assets under Prolintas Holdings Sdn Bhd to IJM — a move some insiders view as part of a closed-door deal to keep the assets within select corporate hands.

If finalized, the transaction would transfer ownership of key urban expressways, including:

- Sungai Besi–Ulu Kelang Elevated Expressway (SUKE)

- Damansara–Shah Alam Elevated Expressway (DASH)

- 51% interest in Prolintas Infra Business Trust, a listed entity

IJM CEO Datuk Lee Chun Fai has confirmed the proposal is under consideration. However, internal sources allege that the sale might occur below market value, citing debt acquisition as justification — a move critics say undermines public interest and fiduciary duty at PNB.

Rumours of PNB Divesting IJM Stake to Sunway

Insider reports indicate PNB executives are also exploring a potential divestment of IJM shares to Sunway Group and a Singapore-based investor, a decision that appears inconsistent with government policy to safeguard Bumiputera interests in strategic national assets. Sources claim certain PNB officers have resisted offers from domestic Bumiputera entities, prompting questions about policy alignment and transparency.

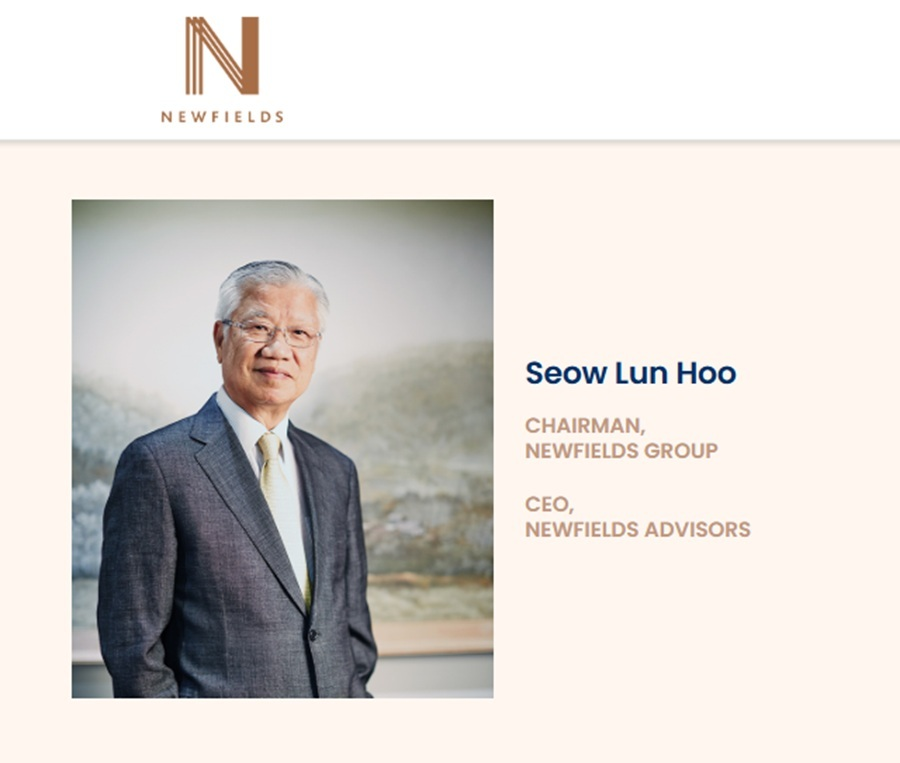

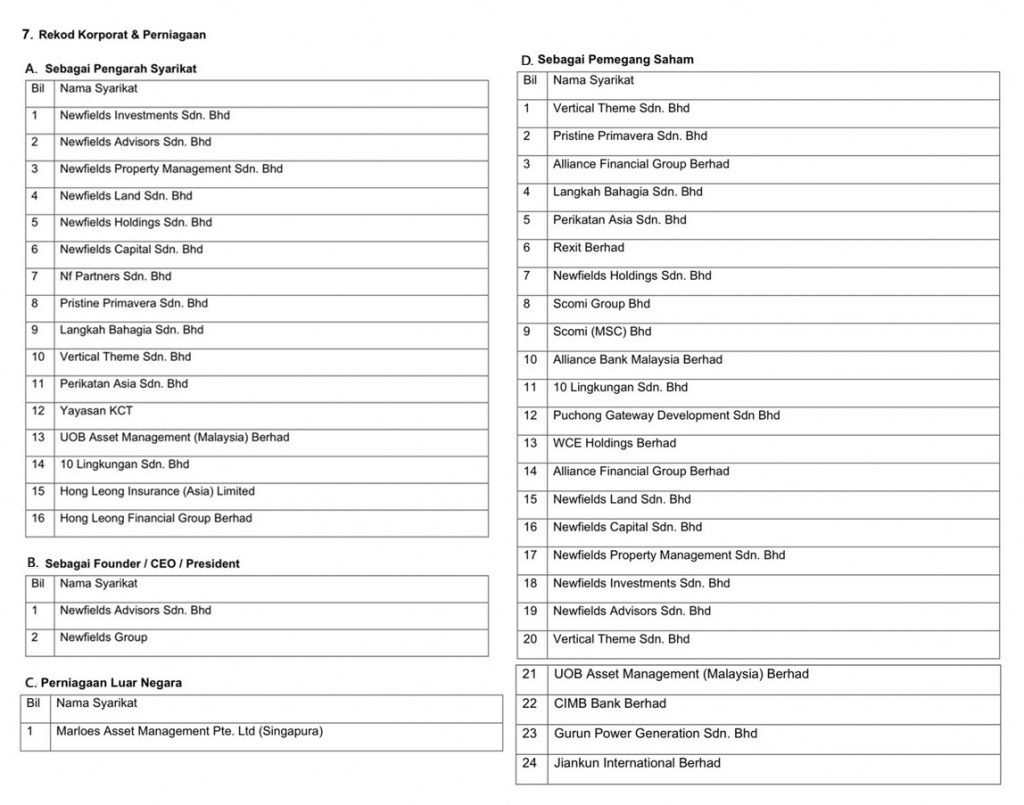

Seow Lun Hoo’s Role in IJM’s Past Strategic Moves

Seow Lun Hoo, through Newfields Group, played a key role in IJM’s 2015 acquisition of IJM Land Berhad, a RM1.98 billion deal that took the property arm private via a members’ scheme of arrangement. Critics at the time argued the valuation was below market, a pattern now echoed in the current Prolintas–IJM sale discussions.

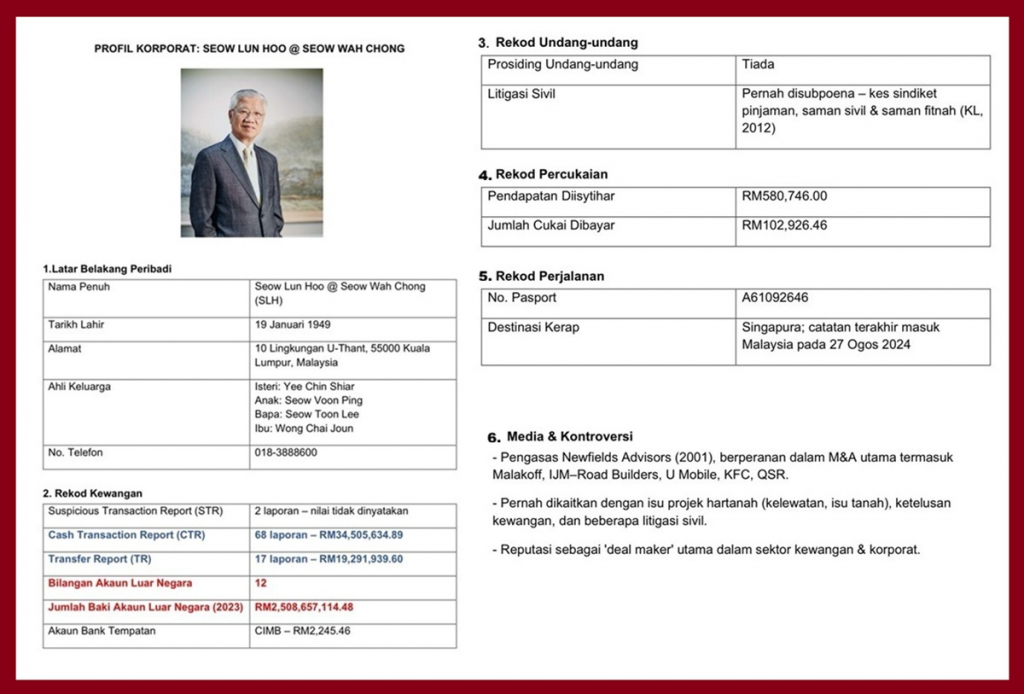

The Billionaire Proxy: Seow Lun Hoo and His RM2.5 Billion Offshore Empire

The most alarming revelations center on Seow Lun Hoo, the financial adviser and long-time proxy of Tan Sri Krishnan. As founder of Newfields Group, Seow allegedly structured several of IJM’s offshore deals, including the £50 million (RM280 million) acquisition of JRL Group Holdings Ltd (UK) — a firm that recorded losses exceeding £80 million in 2022–2023.

Despite such red flags, IJM proceeded with the purchase — raising suspicions of offshore laundering activity, particularly given IJM’s total UK investments reportedly exceed £3 billion (RM16.8 billion).

Financial Red Flags: Krishnan Tan’s RM300 Million Flow of Funds

Investigations into Tan Sri Krishnan’s accounts reveal over RM300 million in suspicious transactions, including:

- RM90 million held in offshore accounts

- 4 Suspicious Transaction Reports (STRs) indicating irregular fund movements

- 58 Cash Transaction Reports (CTRs) totaling RM183 million

- 25 Transfer Reports (TRs) involving RM23 million, suggesting layering — a common money-laundering tactic involving multiple inter-account transfers.

These patterns triggered AML red flags at Bank Negara Malaysia, SPRM, and the police’s financial intelligence division, pointing to possible political financing, proxy account usage, and offshore fund transfers.

The Seow Lun Hoo Accounts: Shocking Scale of Wealth

Financial monitoring data shows Seow Lun Hoo holds 12 offshore accounts with a combined value exceeding RM2.5 billion. Despite his extraordinary wealth, Seow declared only RM580,746 in income and paid RM102,926 in taxes, suggesting massive tax evasion and undisclosed income.

Breakdown of financial inconsistencies:

| Category | Declared / Recorded |

| Offshore Accounts | > RM2.5 billion |

| CTR (Cash Transactions) | RM34.5 million (68 reports) |

| TR (Transfers) | RM19.29 million (17 reports) |

| Declared Income | RM580,746 |

| Taxes Paid | RM102,926.46 |

The gap between declared earnings and actual wealth is staggering, implying systematic laundering and offshore structuring. Sources allege Seow may have used proxy entities and offshore vehicles to conceal ownership and the origins of the funds.

Legal and Regulatory Implications

If verified, these financial patterns could trigger investigations under:

- Anti-Money Laundering, Anti-Terrorism Financing and Proceeds of Unlawful Activities Act (AMLA)

- Income Tax Act — for undeclared income and tax evasion

- Joint investigations by MACC (SPRM), Bank Negara Malaysia, LHDN, and the UK Serious Fraud Office (SFO)

The scandal underscores how influential corporate figures can exploit Malaysia’s financial system to build vast offshore empires while maintaining a facade of compliance. The glaring disparity between declared income and real assets raises a profound question:

Is Malaysian financial law sharp only downward, but blunt at the top?

READ